- Shares of Pfizer, Moderna, and BioNTech all rebounded on Friday, each jumping about 2%.

- The move higher came after the FDA authorized a third COVID-19 booster shot for the immunocompromised.

- The companies expect strong demand for its COVID-19 vaccine into 2022 and beyond.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Shares of Moderna, Pfizer, and BioNTech each jumped about 2% on Friday, rebounding from a sharp two-day decline experienced earlier in the week.

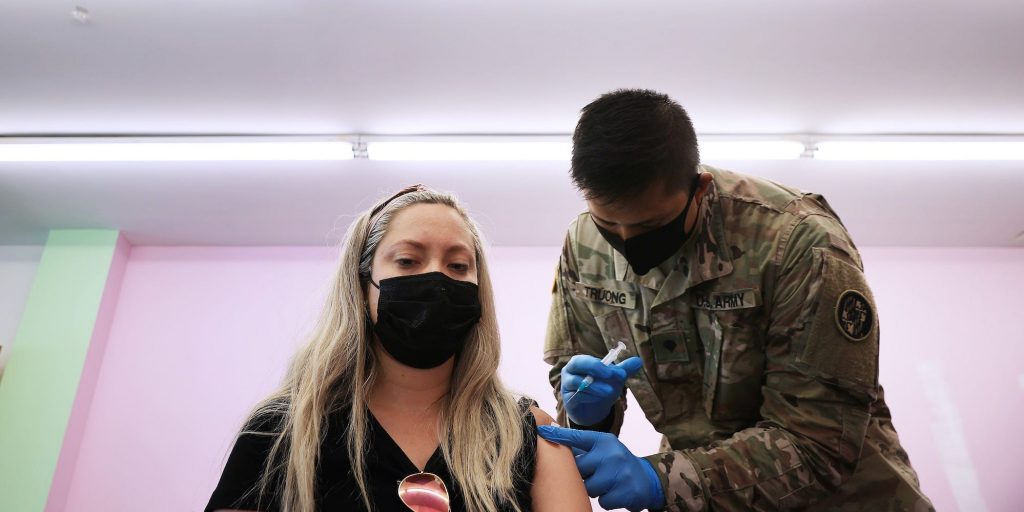

The move higher on Friday came after the FDA authorized a third COVID-19 booster shot of Moderna or Pfizer/BioNTech's vaccine for the immunocompromised. The agency said it evaluated data that found the booster shot may increase protection in this segment of the population.

Shares in all three companies have been wildly volatile this week after second-quarter earnings from BioNTech and Moderna revealed extraordinary revenue and earnings growth, driven by their effective vaccines. And demand for the vaccines is expected to continue into 2022 and beyond, BioNTech said on Monday.

That demand could come from the potential for booster shots being authorized for the general population, upcoming FDA approval of the vaccines, and expected approval of the vaccines for children.

The bullish outlook for the continued distribution of their COVID-19 vaccines led to Pfizer eclipsing its record high reached in 1999, and Moderna temporarily being worth more than Merck at a valuation of almost $200 billion. But uncertainties around the likelihood of a third booster shot helped shares turn lower on Tuesday and Wednesday, with Moderna wiping out as much as $40 billion in market value.

One analyst thinks shares of Moderna are getting ahead of themselves, arguing that its current valuation is unjustifiable and could fall as much as 76%.

Year-to-date, shares of BioNTech, Moderna, and Pfizer are up 357%, 275%, and 28%, respectively.

Dit artikel is oorspronkelijk verschenen op z24.nl